The deprecation of third-party cookies has changed buyers’ approach to online video advertising in browser environments, however, despite previous reliance on third-party cookies, programmatic remains strong with two-thirds of respondents allocating the majority of budget to programmatic channels.

The European digital video market is seeing rapid growth. In Europe, it now commands nearly 40% of all display spend and is the fastest-growing segment within social. Innovations in this space, such as advances in video quality, mean that this growth will likely continue at speed. However, the market is highly fragmented by factors including media consumption habits, regulation, and media trading cultures. There is also a lack of research into formats and the factors affecting buying decisions in the online programmatic video space

PubMatic, an independent technology company maximizing customer value by delivering digital advertising’s supply chain of the future, in partnership with IAB Europe, released an industry report titled The State of Online Video Advertising in Europe. The report highlights media buyers’ appetite to continue to increase investment in video advertising, in particular connected TV (CTV).

Over 140 online video buyers from agencies and advertisers across 31 European markets took part in the survey-based research generating key insights such as:

- On average, digital media buyers are investing 36% of total ad spend in video advertising (excluding TV formats)

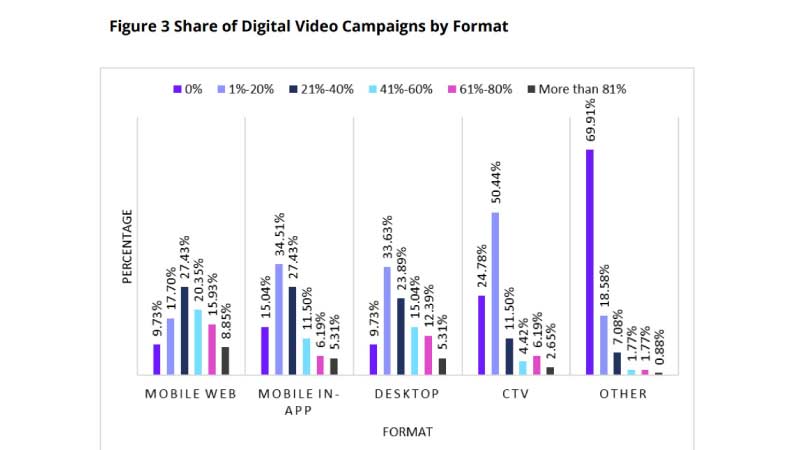

- The most frequently bought video advertising is mobile web with one-quarter of media buyers investing more than 61% of their digital budget in this channel

- Two-thirds of digital buyers are investing in CTV, albeit at a lower percentage of the total budget

“Media buyers are excited about the potential of CTV advertising as it offers a cost-effective way to reach audiences that are viewing far less traditional TV. This is appealing to big brands, while also opening an opportunity for smaller brands to invest in TV advertising without the big price tag attached to linear TV,” said Hitesh Bhatt, Senior Director, CTV/OTT, EMEA at PubMatic.

While programmatic direct is the main buy type for digital video advertising it is only so by a slim margin – 89% of respondents will spend some proportion of their budgets on programmatic direct (where buyers programmatically buy inventory directly from publishers), compared to 82% for direct (where buyers deal directly with publishers using non-programmatic channels) and 81% programmatic real-time bidding (RTB – where buyers bid for inventory through programmatic channels). Clearly, however, when both programmatic variants are combined, this form of buy is preferred over non-programmatic direct channels.

The study also found that when media buyers find the same programmatic video inventory available via multiple sell-side platforms (SSPs) – which is often the case – almost half say performance KPIs are the most important factor in deciding which SSP to work with. This is followed by cost (26%) and data activation (16%).

“This focus on KPIs as a deciding factor in SSP selection highlights the importance of maximizing audience addressability – a known driver of better performance. Combining brand and publisher-owned first-party data, and independent ID solutions help better predict consumer behavior and thus maximizes the size, and accuracy of addressable audiences across the open web,” said Bhatt. “Today, A/B testing different addressability strategies is one of the best ways to establish which partners can deliver the best performance. Early tests show that a portfolio approach delivers the best performance,” said Bhatt.

The deprecation of third-party cookies has changed buyers’ approach to online video advertising in browser environments, however, despite previous reliance on third-party cookies, programmatic remains strong with two-thirds of respondents allocating the majority of budget to programmatic channels.

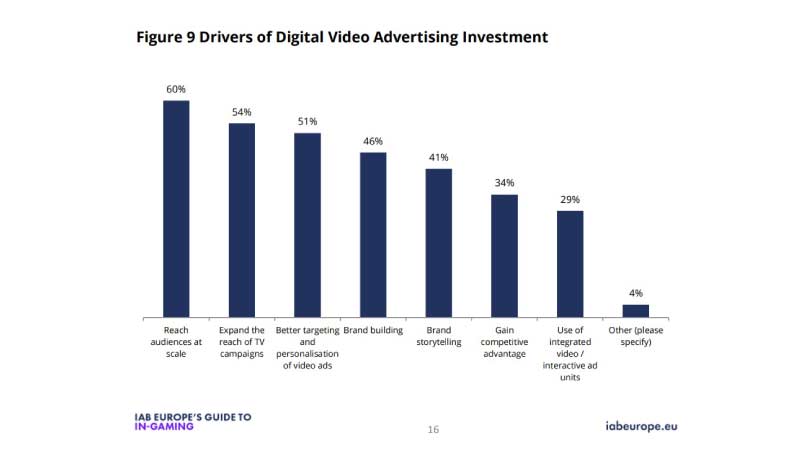

The key to driving more revenue into digital video will be solving a lack of cross-screen measurement cited by 46% as the biggest barrier, and 57% actively seeking more measurable formats. Despite measurement being a significant challenge, almost one-quarter (23%) of digital media buyers are planning digital campaigns as cross-screen including TV in that definition.

Marie-Clare Puffett, Senior Manager, marketing & industry programmes, IAB Europe commented on the research, “IAB Europe and PubMatic’s The State of Online Video Advertising study provides a view into the direction of travel in Europe for this growing advertising market. The findings will help advertisers, publishers and the broader digital advertising industry plan ahead, and make the most of the opportunities on offer. This report shows that advertisers view online video as a strong channel for brand building. However, there are also clear concerns around cross-device targeting that will need to be addressed for the value of online video advertising to be realized in full. Given the aptitude for innovation in the digital advertising sector, I have every confidence these concerns will be overcome and online video will continue as an important channel for brand building.”