Firework, a livestreaming commerce and digital transformation platform, has secured $150 million in Series B financing, led by SoftBank Vision Fund 2.

The announcement comes as public sentiment towards Big Tech’s “walled gardens” – the large, closed ecosystems typified by the likes of Facebook and Amazon – grows increasingly strained. Facebook parent company Meta’s recent announcement that it will charge a 47.5% fee on all transactions on its Horizon Worlds metaverse app was the most recent flashpoint to emerge from the debate around Internet centralization.

With the newly acquired funds, Firework aims to accelerate growth across a variety of metrics in pursuit of a bold, long-term vision to reshape the digital landscape with its decentralized infrastructure on which organizations can engage and transact with customers and audiences on their own properties and terms. In the near term, the company aims to increase talent acquisition in engineering, product, and marketing, and deliver several enhancements to its overall platform.

“This investment will trigger accelerated growth across markets and particularly India,” said Firework Chief Revenue Officer, Jeff Lucas. “Over the last 24 months we have built a robust platform and business model and they have contributed to the customer successes we have had. The capital will not only help us continue building these success stories but also ensure that Firework, as a platform never loses step with the bleeding edge of next-generation customer experience.”

Success begets success

The outcome of Firework’s Series B funding round can be attributed in large part to a litany of successes stretching back to Q1 2021. With multiple blockbuster customer and partner acquisitions — such as ITC Foods, Sugar Cosmetics, Big Bazaar, Boat, Fab India, The Man Company and Omnicom Media Group — a strategic investment partnership with American Express Ventures, and numerous high-profile leadership hires, Firework has emerged as the clear frontrunner in the race to lead India’s still-nascent livestream commerce market.

In China, livestream commerce generated over $300 billion in sales in 2021, representing approximately 12% of overall retail ecommerce sales, and is expected to reach nearly 20% in 2023. The North American market, on the other hand, clocked in at less than $6 billion, representing just 0.1% of overall online sales. The immensity of the opportunity therein wasn’t lost when Firework launched in 2017. Nor has it gone unnoticed by investors. Firework has raised over $235 million in funding to date.

But vision determines its value

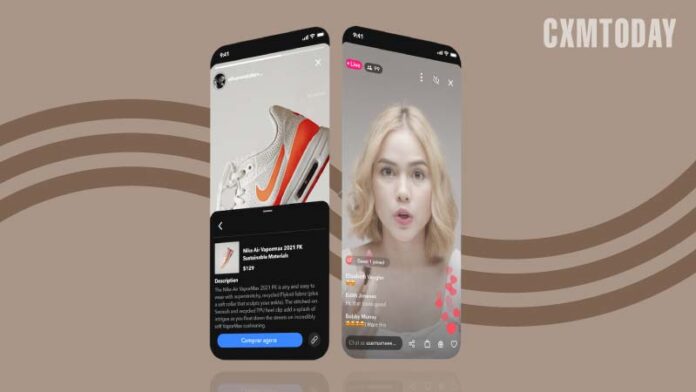

“Short videos and livestreaming are now the default language for the digital era, which is reshaping how consumers engage with brands and products online,” said Linda Yu, Partner at SoftBank Investment Advisers. “We believe Firework empowers businesses to use video to transform their websites into social and storytelling hubs so they can build deeper, long-term relationships with customers. Firework has assembled an impressive team in the digital commerce space and we’re thrilled to partner with them to build a next-generation customer experience.”

As part of the transaction, Linda Yu has joined Firework’s Board of Directors.

“SoftBank Investment Advisors brings deep knowledge and expertise with years of experience in the D2C space,” said Firework India CEO Sunil Nair. He added “Firework’s ambition to shape the next generation of internet and to become the infrastructure on which the next generation of the internet is built and run will be driven by our shared vision.