The New Business Resilience Report from Qualtrics illuminates industry strengths and weaknesses among travel, hospitality, service providers and more

Product and brand appeal propelled the technology and financial industries to the top of the inaugural 2022 Qualtrics Business Resilience Report.

The health of an organization goes beyond its near-term financial results in a business environment where consumers have more options than ever, employee turnover is near record highs, and executives only expect both groups to become more demanding. The Qualtrics Business Resilience Report draws insights from previously unexamined metrics across 20 major industries to quantify how well they are building durable relationships with their employees and consumers. These metrics – employee and customer sentiment, product appeal and brand affinity – are critical to a healthy business and define what Qualtrics is calling “business resilience.”

As many companies reign in spending and lowered growth expectations in their second quarter earnings reports, the index shows that companies in technology and financial industries ended Q2 best situated for long-term success. By comparison, the airline and rental car industries struggled to meet customer expectations while grappling with supply chain and staffing shortages as Americans returned to travel.

With the U.S. economy just exiting a bear market and the summer travel crunch exacerbating staffing and scheduling challenges, future editions of the Business Resilience Report will reveal how well finance and travel industries navigate.

“When companies are faced with something they can’t change – such as inflation or supply shortages – it’s paramount that they invest in the aspects of their business they can control,” said Bruce Temkin, head of Qualtrics XM Institute, which developed the index. “Successful organizations build strong, human connections, and this new report offers a view – for the first time ever – of which industries are building resilient relationships that can withstand external pressures at a high-stakes time for many global industries.”

Additional insights from the Business Resilience Report:

- Technology companies’ public statements about social issues may have strengthened customer affinity with their brands. More than 70% of consumers said the companies shared similar values to their own, 8 percentage points more than any other industry. That advantage made up for average scores in other categories like how useful the products are and how easy it was to interact with the company.

- Tech employees cited a strong sense of personal accomplishment from their work, and were likely to recommend their company as a great place to work, even as many workers looked for new jobs as part of the Great Resignation.

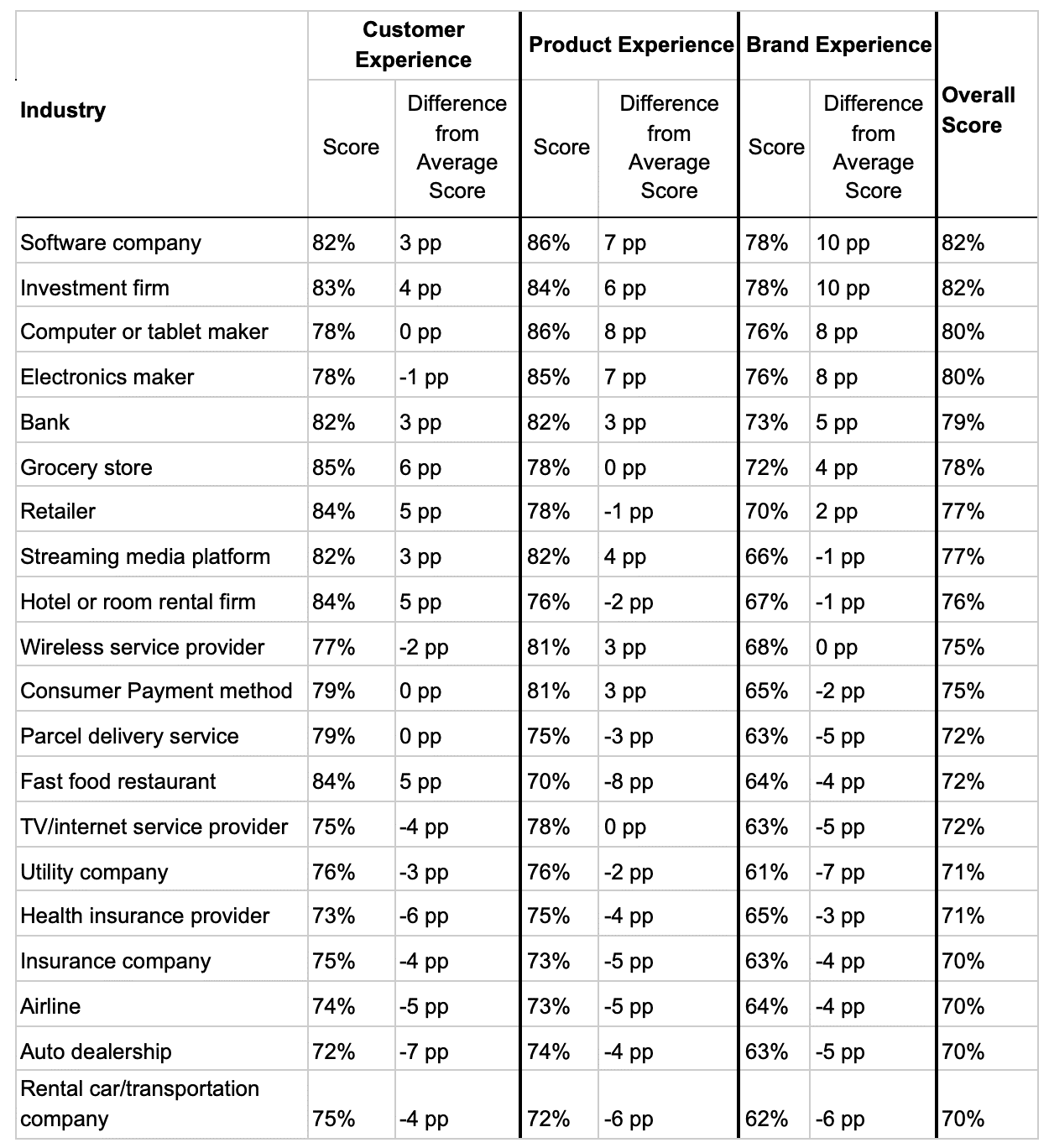

- Hotels and room-rental companies gave travelers a great customer experience, making up for below-average ratings in how innovative their services are, as seen in the chart below.

- The fast food restaurant industry also saw great customer experience scores, but was unable to overcome products that customers reported were neither innovative nor reliable, and brands that customers said they do not trust.

Gen Z are especially discerning consumers

Across all industries, young consumers (18-24 years old) were hardest to impress – members of Generation Z gave the lowest overall ratings in the index. They were least likely to find products reliable or useful, and reported the most difficulty in working with organizations. Gen Z also demonstrated low brand affinity; they had the lowest trust in organizations and were least likely to say brands appeal to them.

When it comes to the workplace, Gen X and younger Baby Boomers (employees who are 45-64 years old) gave lower scores, especially in their lower likelihood to go above and beyond at their job.

“Gen Z consumers have high expectations of the organizations they do business with, and so far companies aren’t meeting them,” said Temkin. “This generation is coming into their power as a trendsetting force, and not responding to their expectations could be a risky proposition for major companies.”

The data for this report comes from three simultaneous surveys Qualtrics XM Institute conducted in Q2 2022. Using online panels, XM Institute collected data from 10,062 US consumers, 2,501 US employees working at one of five targeted industries for a total of 500 employees per industry, and 2,540 US employees demographically representative of the US population according to the 2020 US Census for age, gender, household income, region, and ethnicity. Respondents evaluated three statements for each experience category (customer, product, brand and employee), and XM Institute calculated a composite score for each category based on their answers.

Scores represent the percentage of consumers who agree with statements in each experience category, and are compared with the cross-industry average for each category to identify areas where industries were excelling or trailing relative to other industries in the index. The overall score is the average of the three experience category scores.